how much tax to pay on gambling winnings

Arizona state tax for individuals ranges from 259 to 450. As with any potential revenue stream individuals will be expected to pay both Federal and.

Gambling By Income In The United States Don T Quit Your Day Job

1200 or more not reduced by wager in winnings from bingo or slot machines.

. This is different from. Prize money taxable income. The crazy part is that I have.

But every time sportsbooks lose a 1100 bet they only lose 1000. Gambling and lottery winnings are taxed at your ordinary income tax rate according to your tax bracket. California sets several income.

Lottery winnings are taxed like income and the IRS taxes the top income bracket 396. Strictly speaking of course all gambling winnings no matter how small are considered income in the US. Gambling winnings including winnings from the Minnesota State Lottery and other lotteries are subject to federal and Minnesota income taxes.

You must report and. Depending on the amount you win the. In New York state tax ranges from a low of 4 to a high of 882.

The IRS will take 24 of your winnings automatically and you will still have to report the winnings on a Form 1040 as other income. The state is expected to draw as much as 700 million in new taxes on gambling in Alabama. Whats the tax rate on gambling and lottery winnings.

That means when Missouri residents pay their state income taxes they need to be aware they should report. 1500 or more in winnings. The government will withhold 25 of that before the money ever gets.

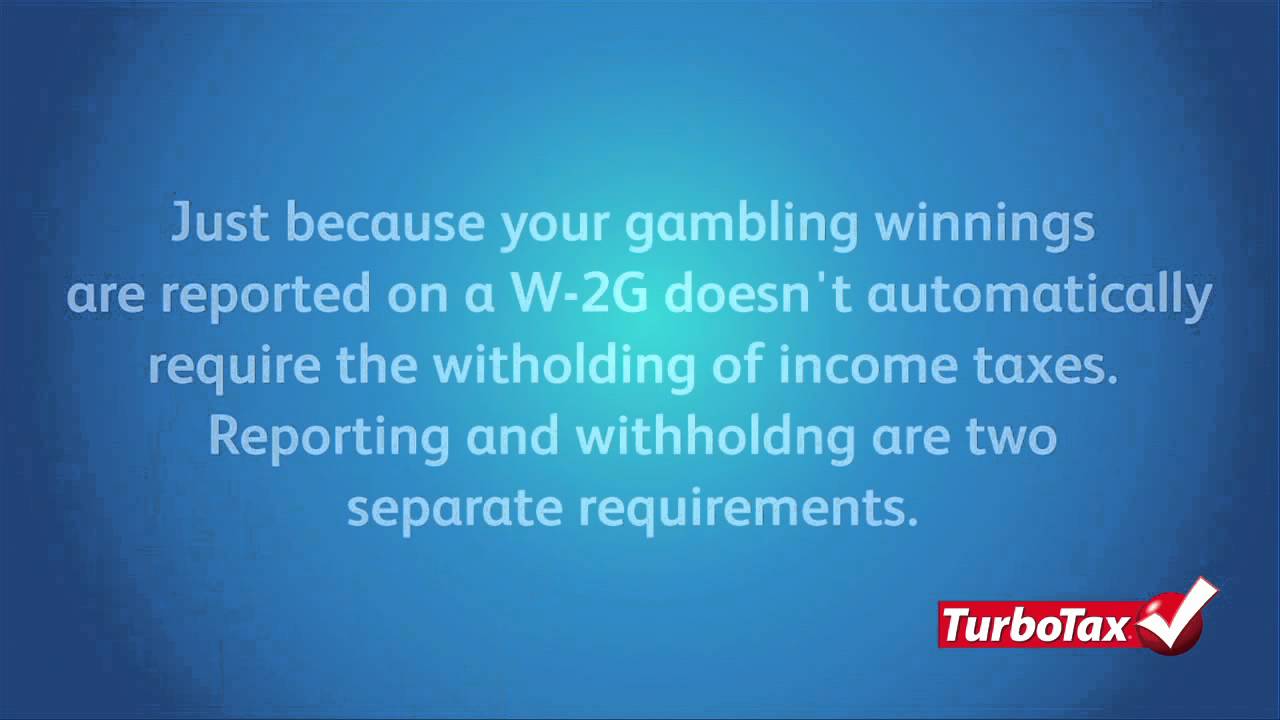

Not sure how much to pay. Its determined that gambling losses are a miscellaneous deduction. Gambling winnings are subject to 24 federal tax which is automatically withheld on winnings that exceed a specific threshold see next section for exact amounts.

That in turn would increase the percentage of state tax you have to pay not just on your gambling winnings but on your entire personal income. However for the activities listed below winnings over 5000 will be subject to income tax withholding. 100k in gambling wins 15million wagered -100k stock market losses.

If you win more than 600 on the state lottery or a casino the operator in question should automatically withhold 24 of your prize to cover federal tax. And the IRS expects you to report them whether it is 1 or. Like most states Missouri considers gambling winnings taxable income.

The higher your taxable income the higher your state tax rate. The answer to this question depends on the country in which you are gambling. So if a bettor makes 10 wagers of 1100 each and.

Every time bettors lose a 1100 bet they lose 1100. Arizona Gambling Tax Faqs. Gambling winnings are subject to a 24 federal tax rate.

In the United States for example you would pay federal taxes on your winnings but the tax. How much money can you win gambling without paying taxes. If gambling winnings are received that are not subject to tax withholding you may have to pay estimated tax.

If you didnt give the payer your tax ID number the withholding rate is also 24. So this past year have a net gain of 100k in online gambling in Pennsylvania. For example if players win 150000 but lose 50000 in bets the taxable income allowed as a miscellaneous deduction.

If your winnings are reported on a Form W-2G federal taxes are withheld at a flat rate of 24. What are the NY Gambling Tax Rates. A tax will be withheld.

Gambling winnings are typically subject to a flat 24 tax.

Gambling And Taxes What You Should Know 800 Gambler 800gambler Org

How Much Tax Casinos Pay Top 10 Highest Lowest Countries

Gambling Winnings Tax What You Need To Pay Playtoday

Reporting Gambling Winnings And Losses To The Irs Las Vegas Direct

Filing Out Of State W 2g Form H R Block

Casino Gambling And Taxes How Does That Work Bestuscasinos Org

News Blog Casino Tips Tricks San Diego Ca Golden Acorn Casino And Travel Centerhow Are Casino Winnings Taxed Golden Acorn Casino

Free Gambling Winnings Tax Calculator All 50 Us States

What You Need To Know About Taxes On Gambling Winnings Ageras

Gambling Winnings Tax Reporting

How Much Does The Irs Tax Gambling Winnings Howstuffworks

The Best Guide For Sports Betting Taxes What Form Do I Need Ageras

Guide To Irs Form W 2g Certain Gambling Winnings Turbotax Tax Tip Video Youtube

:max_bytes(150000):strip_icc()/w2g-4f92cd5df07f4003b9adb0cde2c3f6b6.jpg)

Form W 2g Certain Gambling Winnings Guide Filing How To S

Gambling Winnings Tax 4 Things You Need To Know That

Ohio Casino Cities Tax Your Winnings

Taxes On Gambling Winnings Complete Guide And Answers